The Nigerian education loan fund is a special initiative signed into law by President Bola Ahmed Tinubu’s administration to ensure that students can meet up with their financial demands while in school. It is a special program that is aimed at retaining students in higher education and decreasing the rate at which students drop out due to financial demands that are beyond their control.

Amidst the positive impact this Student Loan scheme holds for Nigerian students, it has come under some level of critique with some persons seeing it as a cheat on the educational system. Those people saw it as an abnormality that should not have happened as such funding should have been better channeled into subsidizing education to make it cheaper for both the rich and the indigent students.

This initiative came into existence following the President’s signing of the Access to Higher Education Bill into law in 2023 as moved by Hon. Femi Gbajabiamila.

Most of the students in higher education can hardly afford their daily food much more going for their tuition fees; therefore is no doubt that this great plan from the federal government will deliver much to the people of Nigeria.

Access this NELFUND student loan is simple and we have simplified all the need steps and things you need to know about this loan.

Aims of the Nigerian Student Loan Initiative

- Facilitate Financial Access to Higher Education: Some Nigerians who, even with their level of brilliance, don’t have sponsors with deep pockets may not consider university but with this initiative from the government, they can reawaken such hunger and it will be well and alive again.

- Collaborate with Stakeholders for Impact

- Enable Equal Opportunity for All Nigerian Students: By doing so, the current administration has closed the gap between the wealthy and the indigent when the educational pursuit is involved. This has also provided educational opportunities to every child in Nigeria who is desirous to attain higher education after secondary school.

- Promote Education for National Development: One key way of ensuring long-lasting development in any country is to ensure that the total number of those educated is more than those who are not educated. This will give the upper hand to the economy of such a country and equally allow her to compete favorably with others.

Benefits of the Student Loan Scheme

- Interest-free loans for tuition fees

- Equal access to higher education for all eligible candidates.

- Reduced financial stress on students and families

- Reduce the level of social and physical vices within the country.

- Provide the platform for interested students to attain the highest level of education they want.

- Relieving burdens in homes, especially when financial inflow is poor.

- Help Nigeria to have graduates

Nigerian Education Loan Scheme application portal

It is important to note that the application for this student loan is simplified and does not involve a complicated interface while applicants are on the portal. The NELFUND student loan portal is created to make things more easier for every student. Below are the four main things to know before clicking the button to apply:

- Interest-Free LoanNo hidden charges, completely interest-free

- Fast & EasyComplete student loan applications within 15 – 30 minutes.

- Safe & SecureBuilt in security to keep all your data safe

- Flexible Payment DurationPayment of student loans begins two years after NYSC

Requirements for the application of the Nigerian Student Loan Scheme

- National Identification Number

- Bank Verification Number

- University matriculation number

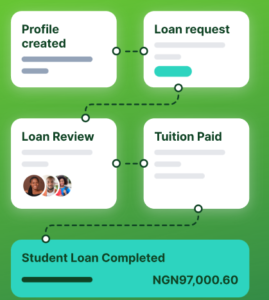

Step-by-step approach to applying for the Nigerian Education Loan Fund

- Register on the Student Loan Application Platform by clicking the “APPLY NOW” button to get started. However, if you already registered, you will need to click the button “Login“.

- Click on the “Request for Student Loan” button complete the loan application steps and submit.

- Your application will be reviewed. After successful verification, payments will be made to your institution for institutional charge, while the upkeep loan will be paid to the bank account you have provided in your profile.

- The processes involved in applying for and receiving the applied loan are already summarized in the image below.

NELFund student loan disbursement

This loan disbursement will be done as soon as your application is reviewed and seen convincingly that the information supplied is correct. If you have met all the laid down rules then you should see the loan disbursed into your account.

NELFUND Repayment of Loan

Students who are under this scheme are to pay back within two years of completion of their NYSC. This loan is not like the scholarships that are being organized by most state governments in Nigeria as a means to support their citizen toward stress-free academic work. They can make their payment on or before that period, depending on the amount of money they have.

However, if a student dies before repaying the loan, the federation government will pardon them and free their parents from paying for it.

FAQs of Nigerian Education Loan Fund

Under what circumstances would NELFUND deny an application?

1. If such an applicant is proven to have defaulted in respect of any previous loan granted by any licensed financial institution.

2. Found guilty of submitting fake/fraudulent documents and dismissed for exam malpractices by any school authority.

3. Convicted of fraud and forgery, drug offenses, cultism, felony, or any offenses involving dishonesty.

Are there any documents to upload during the application process?

Yes. Scanned admission letter for new students (compulsory), scanned Student Identification Card (optional). Beyond the above, you will need to provide your university Matric number to show a link with your university.

Is there any appeal process when an application is denied?

A complaint can be raised from the portal, or you can send an email to the NELFUND. The interesting thing is that everything is done through the website allowing the student to easily do it immediately without the challenge of extra financial burden. You can also contact the technical and logistic crew who can review your application again and know why your application for the loan was denied initially. The best way to raise a complaint is through the Nigerian Education Loan Fund complaint desk.

What are the consequences of defaulting on the loan?

Deliberate default could result in penalties, legal action, and potential damage to your credit score. However, it is important to understand that debt is waived away if the debtor dies before making the payment.

Conclusion on Nigerian Education Loan Fund

Despite the enormous gaps this Access to Higher Education Act may fill, it would have been better to subside education for the interest of everyone. This is because the cost of attaining a university education is becoming costly as the days go by. There is also no time the this was the right time to commence this brewing scholarship.